Financial Planning

Many people we discuss don’t know where to invest their money in, what investment option is best for them, or how much they need to save for any financial goal or what type of insurance they need. Many of them invest their hard-earned money in where their trusted colleague or relatives invest in.Many Relationship Managers you meet at your bank’s counter will say they will prepare a financial plan for you and many times it ends up as a sales tool to sell their products. Your financial plan is NOT the advice you receive after spending 20 minutes with your bank Manager to invest an amount every month into the bank’s partner Insurance Company or their associate Mutual Fund schemes .Remember, a banker is an expert in banking, need NOT be an expert in Professional Financial Planning. Your financial plan is NOT what your chartered accountant figures out to reduce your taxes each year. Your Chartered Accountant is an expert in Financial Accounting, need NOT be an expert in Personal Financial Planning.

JOHNY JOSEPH( Founder Director)

A customized Personal Finance Plan provides you higher returns on

your investments and helps you reach your financial goals smartly.

WHAT IS A PERSONAL FINANCIAL PLAN ?

Personal Financial Planning is the process of achieving your life goals by using a set of prudently-selected investment options with your available resources through proper and disciplined money management.A comprehensive financial plan helps you develop a clear understanding of your current financial position and your financial future.Engaging a professional financial planner is like traveling with a trusted tourist guide in a foreign country. The planner becomes your navigator and the financial plan becomes your tourist destinations.With BLUECHIP FBI Financial Planning service, your investments are thoroughly tracked, monitored and regulated to ensure that your goals are always within your grasp.

WHY SHOULD YOU NEED FINANCIAL ADVISORY SERVICES ?

For over the past 17 years, the professionals of BLUCHIP FBI have been developing customized financial plans for NRIs, working professionals, busy executives, and business owners.Whether you’re saving for your future, investing for retirement, living in retirement, or saving for a college education, a home, or other goals, BLUECHIP FBI analyst can help you with best financial planning and continued investment advice.Your customized financial plan will help you to:

- Analyse and understand what exactly your current financial status is.

- Understand where your money is spent and invested mostly.

- Create specific, viable, time-bound life-goals

- Identify your time-specific goals:

SHORT–TERM-GOALS:: The goals which you want to achieve within 1 year.For example: your child’s education.

MEDIUM–TERM-GOALS: The goals you want to achieve within 5 years.For example: your child’s school admission.

LONG–TERM-GOALS: Goals that you want to achieve after 5 years.For example: Retirement, Child’s Marriage or higher education

- Create an action plan recommended specifically for you

- Evaluate investment returns required from different asset allocation

- Formulate Strategies to reduce or avoid taxes by income-splitting and other effective ways.

- Develop strategies to increase personal wealth

- Identify critical areas of personal risk and develop solutions to protect against them

OUR FINANCIAL PLAN WILL ADDRESS YOUR FOLLOWING QUESTIONS:

- What investments options should I consider?

- How much do I need to save for a safer tomorrow?

- Am I currently taking too much risk or too little risk with my investments?

- Am I on the right track?

- Should I borrow to invest?

- Should I have a Housing Loan?

- What are my options to reduce my taxes?

- Should I have Insurance? If so how much and what kind?

- What is the most effective way to transfer my estate to my children?

- When can I retire? What I should do for a better Retirement plan.

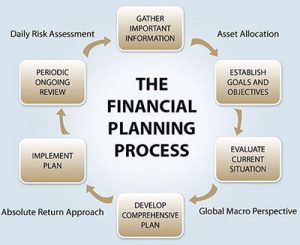

KNOW YOUR MASTER FINANCIAL PLAN

IN A 6-STAGE PROCESS

No goal is achieved without adequate planning.

How can we know what to recommend to you, if we don’t first understand your financial situation?

To determine your current financial position, we want to learn what’s important to YOU and what is not. We want to know your Present Financial Portfolios through a Test Questionnaire, to check its yields, annual returns,to find out which investments are giving you better returns, which are eroding your profits or capital, which investments are advisable to continue, which investments are alarming to discontinue.

Based on the evaluation, we create your customized financial plan.

To prepare your Master Financial Plan, we want to develop your Financial Goals. For that we want your answers on following questions

Am I on the right track currently ? What investments options should I consider ? How much do I need to save for a safer tomorrow ? Am I currently taking too much or too little risk with my investments ? Should I have a Housing Loan ?.What are my options to reduce my taxes ? Should I have Insurance ? If so, how much and what kind ? What I should do for a better Retirement plan.Based on your answers, we will prepare your Financial Plan blueprint. You are encouraged to offer additional suggestions concerning what you would like to see in the plan.

To create your New Financial Plan, we need to identify alternative courses of action

To carry out this, BLUECHIP FBI Experts check your risk appetite on investments, your asset allocation, analyse your medical care/ life insurance, your savings for retirement solutions and prepare a plan suited to your type of financial personality. Your Financial Plan will (1) analyse what exactly your current financial status is, (2) understand where your money is spent mostly (3) create specific, viable, time-bound life-goals,(4) identify your time-specific Short-term,medium term and long term goals,(5) create an action plan recommended specifically for you.

Our team of experts will evaluate how better suited is your new financial plan for your type of Investor personality

We will work with you to devise your planning needs and help you initiate the steps outlined in the plan. We will regularly monitor and report to you on the progress and, should there be a need, modify the plan. We commit to maintain a constant touch with you and meet with you as often as you desire. You can obtain a comprehensive view of your finances and monitor progress towards your goals.

Each individual has unique planning needs, and BLUECHIP FBI will provide the plan that best meets YOUR requirements.

BLUECHIP FBI Managers and back-end team execute the necessary investments converting words into actions. The strategic plan created for you will cover your income taxes, insurance, estate planning, educational funding, retirement and your investment portfolios. Each individual has unique planning needs, and BLUECHIP FBI will provide the plan that best meets YOUR requirements.

Review and follow up is an important part of your Financial Plan

Your plan is reviewed thoroughly to ensure that you completely understand and agree with all aspects of it. The plan is adjusted until you are 100% satisfied. It is important for you to know your plan is on track.The performance of your investments are regularly monitored, tracked and assessed so that all the necessary changes can be made to them for the most optimum returns.All aspects of your financial plans are clearly explained to you to ensure that you are completely comfortable with the plan.

© 2017 Bluechip IFB Topscore Solutions Pvt.Ltd